Travelex Money Card for Singapore

Designed for convenient and affordable travel, the Travelex Travel Money Card is an award-winning card that can hold multiple currencies at a time with no foreign currency conversion fee^. The Travelex Money Card is also compatible at all Mastercard establishments.Enjoy fee free cash withdrawals, great online Singapore dollars exchange rates, and all the benefits of prepaid cards with the Travelex Travel Money Card.

The Travelex Money Card stores money in a savings account so that you can use the Singapore dollar (SGD) and any other foreign currency you prefer in Singapore.

With the Travelex Money Card, you can transfer money (even for online shopping) whenever and wherever you’d like. There is also no international ATM fee with using the Travelex Money Card1.

UNLIMITED FREE overseas ATM withdrawals1

Highly competitive exchange rates

NO fees when you buy online

$0 Currency conversion fee^

24/7 Global Assistance

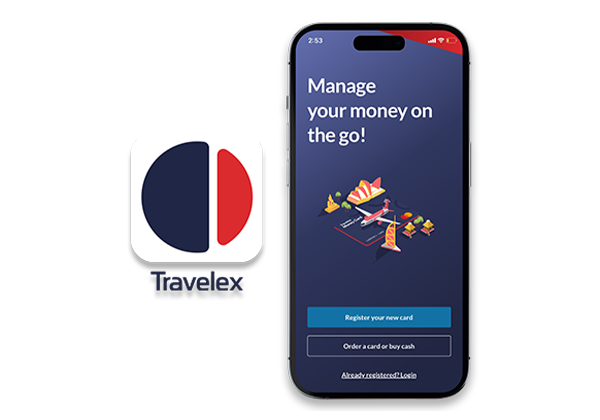

Convenient Mobile App

Download it here

Shop at millions of outlets wherever Mastercard is accepted and on international websites with the local currency

Buy online, collect in-store or get it delivered to your home

(allow up to 7 days from when payment is received)

5☆ outstanding value award winning travel money card

Earn cash rewards for shopping with Mastercard Travel Rewards

TAP & GO with your Android phone via Google Pay™ and Google Wallet™

Read more

Maximise your holiday with our travel card

Order your travel card

Order your Travelex Money Card online or in-store (passport or driver's license required)

Get your travel card

Collect from a Travelex store or delivered FREE to your home (allow up to 7 days from when payment is received)

Register for My Account

To activate your new card, simply register your account via the app or online

Top Up

Manage and check your balance online and on your mobile

Experience the benefits

- Top up your Travelex Money Card wallet

- Check your balance and move funds between currencies

- Instantly freeze and unfreeze your card

- Reveal your PIN and card details for online shopping

The app requires Android 8.0 and up or iOS 14.0 or later.

Compatible with iPhone, iPad and iPod touch.

NO fees online

$0 Currency conversion fee^

Withdraw daily up to AU$3,000 (or currency equivalent)

Maximum Card limit of AU$50,000

Free initial and replacement card

The following fees and limits apply. Fees and limits are subject to variation in accordance with the Terms and Conditions. Unless otherwise specified, all fees will be debited in AU$ Currency

If there are insufficient funds in AU$ Currency to pay such fees, then we will automatically deduct funds from other Currencies in the following order of priority: AU$, US$, EU€, GB£, NZ$, THB, CA$, HK$, JP¥, SG$.

(charged at the time of purchase)

• Online: FREE via travelex.com.au or the Travelex Money App

• In-Store: FREE for loads of foreign currency (loads of Australian dollars (AUD) incur a fee of 1.1% of the amount or $15 whichever is greater).

• Online: FREE via travelex.com.au or the Travelex Money App

• In-Store: FREE for top-ups of foreign currency (top-ups of AUD incur a fee of 1.1% of the amount or $15 whichever is greater).

• BPAY: Top-ups not made via travelex.com.au or the Travelex Money App incur a fee of 1% of the amount.

- MasterCard Biller Code: 184416

- Reference No: your 16 digit Travelex Money Card number

- Funds will be allocated to your default currency. To check your default currency login to your account.

FREE (note: Some ATM operators may charge their own fees or set their own limits)

FREE (note: Some ATM operators may charge their own fees or set their own limits)

FREE

- Charged at the start of each month if you have not made any transactions on the card in the previous 12 months

- Unless your card is used again, or reloaded, this fee applies each month until the card is closed or the remaining card balance is less than the inactivity fee.

AU$4.00 per month

FREE

- Charged when you close your card or withdraw from your Card Fund. This fee is set and charged by Mastercard Prepaid.

AU$10.00

- This is applied when you move your funds from one currency to another currency.

At the then applicable retail foreign exchange rate determined by us. We will notify you of the rate that will apply at the time you allocate your funds from one currency to another.

- Applied when a purchase or ATM withdrawal is conducted in a currency either not loaded or sufficient to complete the transaction and the cost is allocated against the currency/ies used to fund the transaction.

FREE*

*The Spend Rate will apply to foreign exchange transactions in accordance with the Terms and Conditions.

The following fees and limits apply. Fees and limits are subject to variation in accordance with the Terms and Conditions. Unless otherwise specified, all fees will be debited in AU$ Currency

If there are insufficient funds in AU$ Currency to pay such fees, then we will automatically deduct funds from other Currencies in the following order of priority: AU$, US$, EU€, GB£, NZ$, THB, CA$, HK$, JP¥, SG$.

One

Minimum amount for initial purchase in-store

AU$350 or currency equivalent

AU$100 or currency equivalent

AU$50 or currency equivalent

The maximum amount you can load on the card at the time of the initial online purchase is AU$5,000 equivalent.

to a maximum of $10,050 per single top-up; and

to a maximum of $10,050 top-up value over 24hrs; and

to a maximum of $20,000 top-up value over 21 days.

AU$25,000

AU$75,000

AU$350

AU$3,000 or currency equivalent

AU$15,000 or currency equivalent

AU$50,000

Other Important Information

Please read the following information about your Travelex Money Card carefully:

- Your Travelex Money Card does not generate any interest or any other similar return. You do not earn interest on the amount standing to the credit of the Travelex Money Card Fund accessed by the card.

- Although the issuer of the card is an authorised deposit-taking institution in Australia, the Card is not a deposit account with the Issuer.

Important Information about Fees & Limits for loads/top ups made online:

- If you are making a purchase or topping up the Card online via www.travelex.com.au (i) the initial load and top up fee may differ to (but not be greater than) those contained in the “Fees and Limits Table” of this Product Disclosure Statement; and (ii) the limits may differ to those contained in the “Fees and Limits Table” of this Product Disclosure Statement. Travelex may also charge a card surcharge if you pay with a credit or debit card. Please refer to the relevant online terms and conditions available at www.travelex.com.au for details of the applicable fees and limits.

You can buy currencies in addition to SGD and store them all within the same money card. In this way, you can access cash in multiple currencies whenever need be.

Other benefits of travel money cards include:

- Being able to lock in fixed foreign currency exchange rates before travelling

- Storing your money in a secure savings account

- Avoiding annual fees, hidden fees, ATM withdrawal fees, and any reload fee

- Feeling safe when local spending

The Travelex Money App makes ordering, transferring, and checking currencies on your travel card a breeze. You can use the Travelex travel exchange rate tracker to check currencies and Australian dollars exchange rates in real time. Convert AUD to SGD with our convenient currency converter.

Find a store near you or order a travel money card online today.

What is a Singapore travel card?

The Travelex Singapore travel card is an award-winning money card that exchanges and stores SGD prevailing exchange rate. Similar to standard debit cards (however, not like air miles credit cards), the Travelex Singapore travel card can be used to make purchases in stores (via Mastercard) and to withdraw cash at ATMs while travelling.

You can buy currencies in addition to SGD and store them all within the same money card. In this way, you can access cash in multiple currencies whenever need be.

Are travel money cards good?

Travel money cards can be incredibly helpful to have when spending overseas. They make foreign currency transactions easy and, in the case of Travelex, are mostly fee free. This means you can avoid paying an annual fee and save money (compared to using a credit card).

Other benefits of travel money cards include:

- Being able to lock in fixed foreign currency exchange rates before travelling

- Storing your money in a secure savings account

- Avoiding annual fees, hidden fees, ATM withdrawal fees, and any reload fee

- Feeling safe when local spending

What is the best travel money card for Singapore?

The best travel money card for Singapore is one that’s easy to use and helps you save money. The Travelex Travel Money Card is a great option for storing and exchanging money during your travels. Not only is it majorly fee-free, but it is also quick and easy to reload money into your travel money card account via the Travelex Money App.

The Travelex Money App makes ordering, transferring, and checking currencies on your travel card a breeze. You can use the Travelex travel exchange rate tracker to check currencies and Australian dollars exchange rates in real time.

Convert AUD to SGD with our convenient currency converter.

Find a store near you or order a travel money card online today.

Is it better to use cash or card in Singapore?

Card payments are widely accepted in Singapore; however, cash is always beneficial to have on hand when visiting areas such as traditional markets. Travel money cards are great for both card and cash use, as users can simply withdraw money from a nearby ATM (without any ATM withdrawal fees1) whenever they need it. While using the travel money card, converted cash is stored in an account similar to a standard bank account.

When can I use travel cards?

You can use the Travelex Money Card in multiple situations where you may need to make a purchase in the local currency or withdraw cash. It can be used for hotel transactions, to purchase fee-free travel insurance, and for a host of other purchasing purposes.

1 Please be advised that although Travelex do not charge ATM fees, some operators may charge their own fee or set their own limits. Please check with the ATM before using

3 Lock in your exchange rates mean the exchange rate is locked in for the initial load only. The exchange rates for subsequent reloads will be set at the prevailing exchange rate at the time of the transaction.

Mastercard Prepaid Management Services Australia Pty Ltd (ABN 47 145 452 044, AFSL 386 837) arranges for the issue of the Travelex Money Card in conjunction with the issuer, EML Payment Solutions Limited (‘EML’)(ABN 30 131 436 532, AFSL 404131). You should consider the Product Disclosure Statement for the relevant Travelex Money Card and Target Market Determination available at www.travelex.com.au, before deciding to acquire the product. Any advice does not take into account your personal needs, financial circumstances or objectives and you should consider if it is appropriate for you. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

^ A foreign exchange ‘Spend Rate’ rate will apply to foreign exchange transactions in accordance with The Product Disclosure Statement.

* Transacting via some online merchants may incur a surcharge.

NZ

NZ

Europe

Europe

US

US

Japan

Japan

UK

UK

Canada

Canada

Hong Kong

Hong Kong

Thailand

Thailand

Singapore

Singapore